Matter of the inclusion of Petrol/Diesel below the GST regime deferred by the GST Council

The Minister of State, Shri Rameshwar Teli within the Ministry of Petroleum And Natural Gas in a written reply to a question raised in Lok Sabha Stated, “Matter of inclusion of Petrol/Diesel under GST regime deferred by GST Council.”

Prices of petrol and diesel within the nation have been market-determined with impact from 26.06.2010 and 19.10.2014 respectively. Since then, the Public Sector Oil Marketing Companies (OMCs) take an applicable choice on the pricing of petrol and diesel. Effective 16 June 2017, daily pricing of petrol and diesel has been carried out in the complete nation.

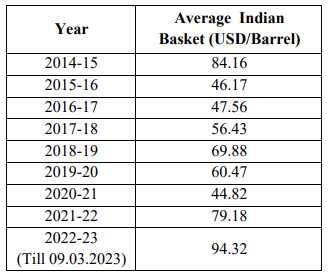

The yearly common worldwide costs of the Indian basket of Crude oil since 2014-15 are given below:

The crude oil price in USD/Barrel terms doesn’t reflect the depreciation of the INR/USD exchange charge.

The particulars of the contribution to the Central Exchequer from excise responsibility on petroleum products since 2014 are given below:

The above is predicated on information offered to Petroleum Planning and Analysis Cell (PPAC) by 15 main oil & gas corporations.

The GST Council in its 45th assembly held on 17th September 2021 had thought of the inclusion of Petrol/Diesel and different petroleum products under the GST regime but the matter was deferred by the Council until bigger deliberations on account of its heavy repercussions on the exchequer. The difficulty has not been taken up by the Council as agenda merchandise for any additional deliberation after the said meeting.