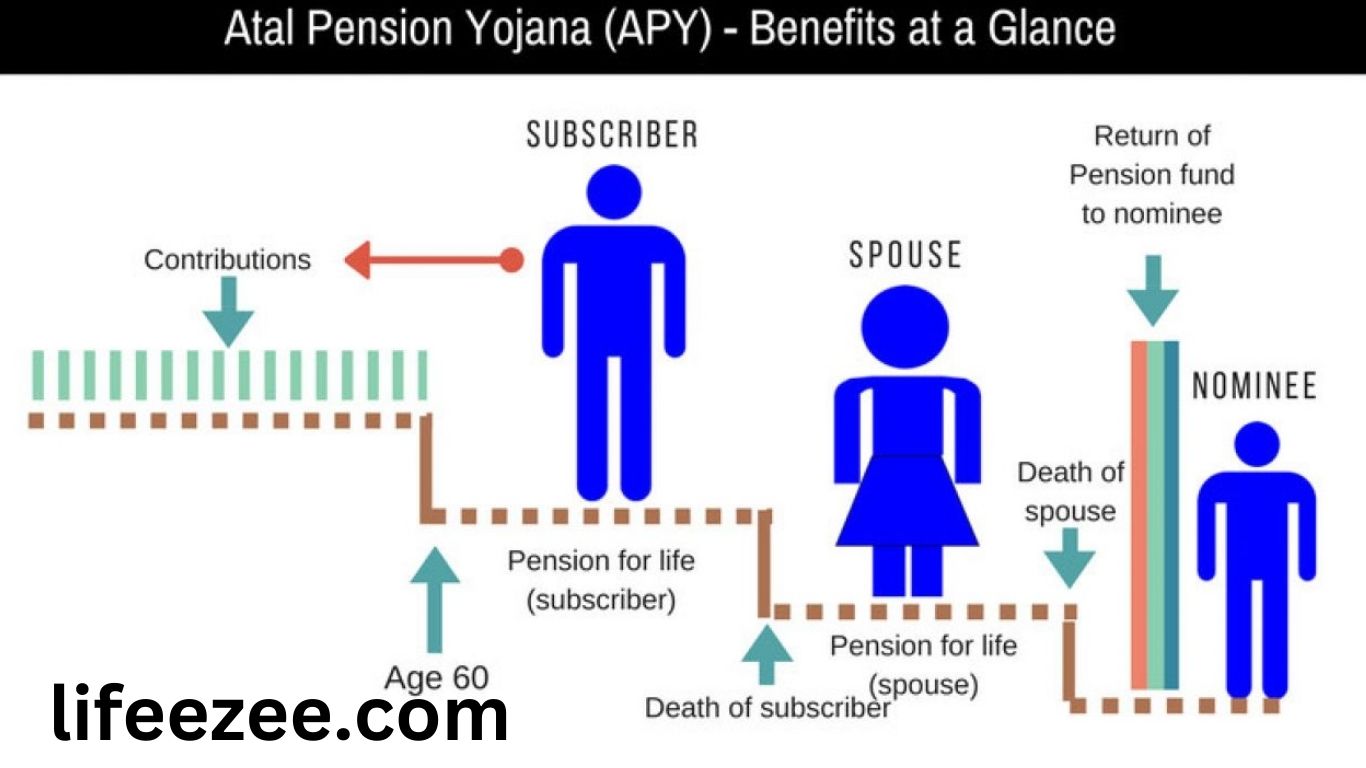

Pension Benefits: There is a provision within the scheme that if the depositor dies earlier than 60 years, then his spouse/husband can proceed to deposit cash within the scheme and might take a pension every month after 60 years.

Atal pension Yojana Pension Benefits: It is important to do retirement planning. A retirement plan is crucial to be free from worrying about outdated age expenses. However, make investments your deposits in any fund. Make a transfer in direction of secure funding. The authorities’ Atal Pension Yojana (APY) is one such nice choice. Atal Pension Yojana (APY) pension scheme is operated by the pension regulator PFRDA. The scheme began within 12 months in 2015. Although at the moment this scheme was begun for people working within the unorganized sectors, now any Indian citizen 18 to 40 years can invest in it.

The government guaranteed government.

Government of India assure is out there for all the advantages associated with pensions in the scheme. Bank account holders or submit office account holders can spend money on it. Depositors start pensions pension after 60 years within the scheme. Any Indian citizen from 18 to 40 years can spend money on the scheme.

What is Atal Pension Yojana?

Atal Pension Yojana is an authority city scheme, by which investment is determined by your age. Under the scheme, a minimum monthly pension of Rs 1,000, Rs 2000, Rs 3000, Rs 4000 and most of Rs 5,000 will be acquired. If you need to register on this, then it’s best to have a savings account, Aadhar number and mobile number. Keep in thoughts that you would be able to have just one Atal Pension Account.

When will you get the extra benefit?

The sooner you make investments under this scheme, the extra profit you’re going to get. If a person joins the Atal Pension Yatana at the age of 18, then after the age of 60, he must deposit simply Rs 210 per 30 days for a monthly pension of Rs 5000 each month. In this manner, this plan is an efficient revenue plan.

How do get a Rs 60,000 pension?

If you deposit 7 rupees every day within the scheme, then you will get a pension of 5000 rupees each month. Meaning you’re going to get a pension of Rs 60,000 yearly. At the identical time, for a monthly pension of Rs 1000 each month, solely Rs 42 must be deposited per month. And each month Rs 84 for a pension of Rs 2000, Rs 126 for Rs 3000 and Rs 168 for a monthly pension of Rs 4000 must be deposited.

Tax profit

People investing in Atal Pension Yojana additionally get a tax advantage of as much as Rs 1.5 lakh beneath Income Tax Act 80C. Taxable income is deducted from this. Apart from this, a further tax advantage of as much as Rs 50,000 is out there in some cases. Overall, deduct an ion of as much as Rs 2 lakh is out there on this scheme.

Provision for death before 60 years

There is such a provision on this scheme that if the particular person related to the scheme dies earlier than 60 years, the spouse/husband can proceed to deposit cash on this scheme and can get a pension each month after 60 years. There can also be a choice that the spouse of that person can declare the lump sum amount after the loss of life of her husband. If the spouse also dies, then a lump sum amount is given to her nominee.